Why Aren't House Prices Rising As Much As They Used To?

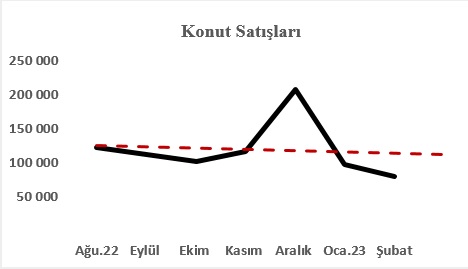

Despite the current high inflation, housing prices have not increased as much as before. What is the reason for this? This is one of the most frequently asked questions in recent days. There are several reasons why the crazy increase in housing prices has slowed down recently. The first of these is that inflation has slowed down, albeit due to the base effect. The second and most important reason is that sales have fallen. Housing demand has lost its former vitality in the last few months. We can monitor the development in housing sales from the graph below (the graph was prepared by me using the data from TurkStat, Housing Sales Statistics Newsletter, February 2023.)

Usually, sales increase in the last month of the year, so although there is a jump in December, the following two months can see a decrease in sales. The trendline is also bearish. Under normal conditions, if inflation rises, housing demand decreases, and prices do not rise as fast as inflation due to low demand. Normal conditions do not apply to us. When the interest rate is 30 points below inflation, people invest their savings in housing instead of depositing them in banks or bonds in order to protect them. This preference increases the demand for housing and therefore housing prices. Recently, deposit rates have started to increase gradually. This development reduced the demand for housing and prices did not increase as much as before. We can monitor this development from the chart below (source: CBRT, Housing Price Index, January 2023.)

The chart shows that the real jump in house prices began in the second half of 2021. Until then, the CBRT's policy rate was at the same rate as inflation (19 percent). At that time, the CBRT started to cut interest rates and continued to reduce the policy rate to 8.5 percent. Banks inevitably complied with this discount and the flight from money began for those who had savings. When it became difficult to buy foreign currency, the stock market and housing remained as options. Those with high savings tended to buy housing and protect the purchasing power of their money in that way. Those with low savings also requested housing by taking housing loans from banks. When the demand increased so much, housing prices skyrocketed. Over the past few months, banks have gradually started to raise interest rates so as not to lose their deposit customers. This change of approach had a significant impact on home sales starting to decline. As of the end of March, when the interest rate ceiling on currency-protected deposits was lifted, the rise in deposit rates and bond yields accelerated a little more. The graphs above do not yet cover the months of these recent changes, so they do not show the exact development. In the coming months, we will see both the decline in housing sales and the decline in price increases much more clearly with every step that interest rates continue to approach inflation. In the second half of 2021, Turkey chose the method of fueling consumption by lowering interest rates well below inflation as its growth model. This model has enabled them to increase their consumption by creating high inflation, on the one hand, the demand that has been pulled forward, which leads to money flight, and on the other hand, the wealth effect, which has led people to think that the value of their assets has increased, and in this way, growth has remained high. This approach created an illusion in people's minds and led them to determine their behavior accordingly.